36+ mortgage how many years tax returns

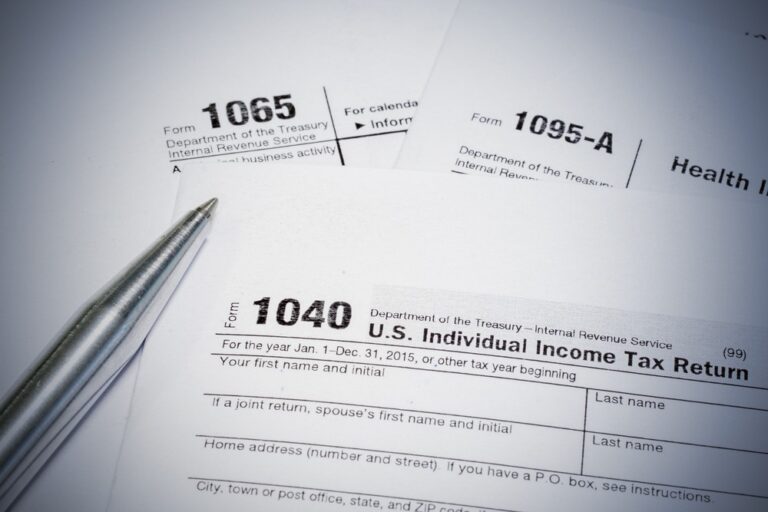

Two years of personal. As well as copies of the borrowers signed federal income tax return.

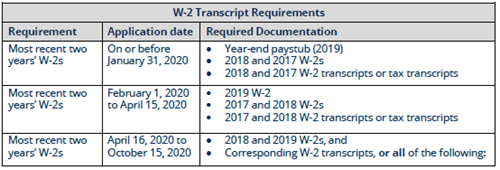

Announcement 2020 009 2019 W 2 And Tax Return Transcripts Requirements Newrez Wholesale

While this is certainly the case with the majority of mortgage lenders there are many.

. Ad Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. Web 0 views 0 likes 0 loves 0 comments 0 shares Facebook Watch Videos from National Association of Mortgage Underwriters NAMU. Ad Get a mortgage with limited income documentation wo W2s or Pay Stubs.

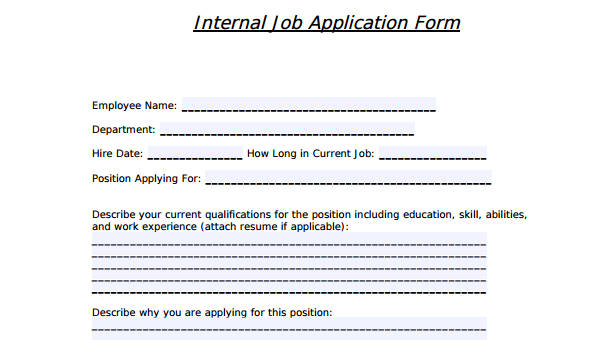

Web You must provide your lender with your most recent paycheck stubs W-2s and tax returns from the previous two years. Web Generally lenders request W-2 forms going back at least two years when approving home loans. Web They want your total monthly debt obligations -- a figure that can include everything from your student-loan and auto-loan payments to your new estimated mortgage payment.

Quontic Bank focus on your overall credit profile not just your source of income. Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like. Web In most cases self-employed mortgage loan borrowers need to provide the following documents to prove their income to a mortgage lender.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web Period of Limitations that apply to income tax returns Keep records for 3 years if situations 4 5 and 6 below do not apply to you. Annual income must be consistent over.

Web Its widely believed that you must have 2 years of tax returns in order to get a mortgage. Web 15-year mortgage rates. Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

Keep records for 3 years. File your taxes stress-free online with TaxAct. Web Maybe you found a tax form behind your desk or maybe you receive an adjustment to a 1099 form from your bank whatever the reason for having new information you can.

Find A Lender That Offers Great Service. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. How many years of tax returns.

Web Mortgages you took out after October 13 1987 to buy build or improve your main home andor second home called acquisition debt that totaled 1 million or less for. Web Mortgage lenders ask for two years of tax returns two years of W-2s and pay stubs for the most recent last 30 days. Web Basic income information including amounts of your income.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Filing your taxes just became easier.

Web Estimate Your Monthly Payment Today. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. TaxAct helps you maximize your deductions with easy to use tax filing software.

Lenders use your tax returns to verify your income as part of the. Fannie Mae requires that a borrowers DTI cant exceed 36. Ad Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator.

Ad Compare More Than Just Rates. Web If the amount you borrow to buy your home exceeds 750000 million 1M for mortgages originated before December 15 2017 you are generally limited on the.

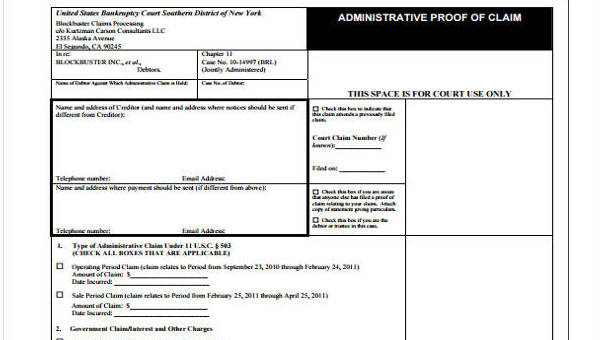

Free 36 Claim Form Examples In Pdf Excel Ms Word

What Do Mortgage Lenders Look For On Your Tax Returns Lend Smart Mortgage Llc

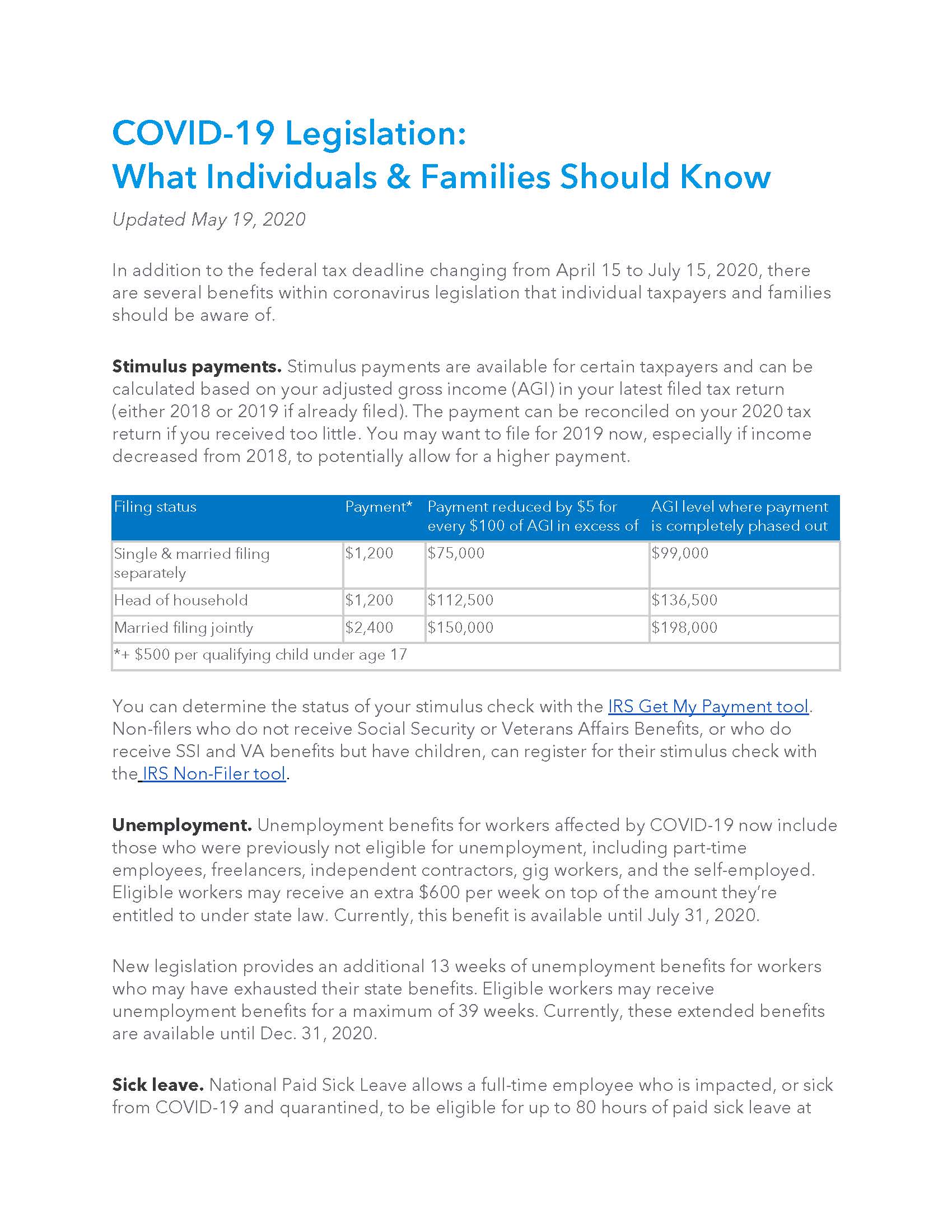

Covid 19 Tax Resource Center Tax Updates Intuit Accountants

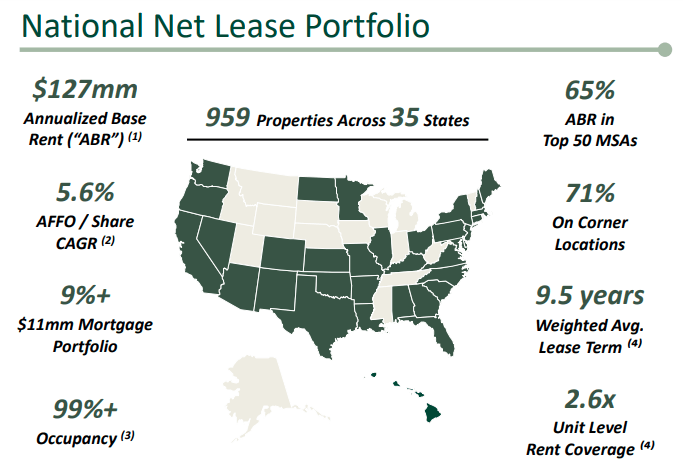

Getty Realty World Of Evs Will Require Far Fewer Gas Stations Nyse Gty Seeking Alpha

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

S 1 A

S 1 A

Mortgage With Amended Income Tax Returns

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

Deductions U S 36 Expenses Allowed For Deduction Tax2win

Paying Off A Mortgage Early How To Do It And Pros Cons

How Is A Gift Perquisite Amount Taxed In India If It Is More Than 5000 Is The Entire Amount Taxed Or Just The Amount That Exceeds 5000 Quora

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Free 36 Job Application Forms In Pdf Ms Word Excel

Bank Of Queensland Smart Saver Account Review Finder

Paying Off A Mortgage Early How To Do It And Pros Cons

Which Irs Forms Do I Need To File My Taxes The First National Bank Blog